[Subject to Change]

Summary of Changes to the 2024-2025 FAFSA

• The changes in the financial aid formula are effective starting with the 2024-2025 FAFSA

• Reduces the number of questions from 108 to about 36

• Align more questions on FAFSA with federal income tax returns

• Automatic transfer of IRS data to the FAFSA

• Increases aid eligibility for single parents

• Decreases aid eligibility for middle- and high-income families

–Shift in focus away from cash flow to a slightly greater emphasis on wealth

• Reduced likelihood of verification because fewer questions and more data transferred from the IRS • New Federal Pell Grant formula

Name Changes

• The new FAFSA changes a few names

–Expected Family Contribution (EFC) -> Student Aid Index (SAI)

–Simplified Needs Test (SNT) -> Applicants Exempt from Asset Reporting

• The new names fix a few minor problems

• The term “EFC” can be misleading, since many families incorrectly believe that the EFC is all they pay

• The term “Professional Judgment” is used in the Higher Education Act of 1965 for the first time

Increases in Financial Aid for Single Parents

• Two types of single parents

–Dependent students with just one parent

–Independent students who are single parents

• Bigger increase in the Income Protection Allowance (IPA)

–Increases by 20% for parents

–Increases by up to about $2,400 (35%) for most students

–Increases by up to about $6,500 (60%) for students who are single parents

• Greater eligibility for the maximum Federal Pell Grant

–AGI less than or equal to 225% of the poverty line (single parent)

–AGI less than or equal to 175% of the poverty line (not single parent)

–This yields similar income thresholds of $38,750 and $38,010, respectively, for families where the student is an only child

Less Aid for Multiple Children in College

• The number of children in college at the same time will no longer affect eligibility for need-based financial aid

• The parent contribution will no longer be divided by number of children in college at the same time

• The income protection allowance will no longer be reduced based on number of children in college at the same time

• Small impact on low-income families with multiple children in college

• Big impact on middle- and high-income families with two or more children enrolled in college at the same time

• Families can appeal for more aid based on having multiple family members in college at the same time

Changes in Reportable Income

• Several types of untaxed income will no longer be reported on the FAFSA

–Cash support and other money paid on the student’s behalf

–Veterans’ education benefits

–Workman’s Compensation

• Elimination of cash support yields certain benefits

–Gifts to the student will no longer be reported as untaxed income

–Qualified distributions from 529 plans that are owned by a grandparent, aunt, uncle, etc. will no longer affect aid eligibility

• Child support received (annual) will be reported as an asset instead of income

Changes in Reportable Assets

• Certain exclusions from assets have been dropped

–The small business exclusion

–Exclusion for a family farm on which the family resides

• The Simplified Needs Test is now known as “Applicants Exempt from Asset Reporting”

–Changes in income thresholds

–Changes in means-tested federal benefits

Auto-Zero and Asset Reporting Exemption

• Replacement for auto-zero EFC

–If a dependent student’s parents or an independent student (and spouse) are not required to file a federal income tax return, the student aid index will be negative $1,500

–Student aid index set to zero if student qualifies for maximum Federal Pell Grant

• Applicants Exempt from Asset Reporting

–Income threshold for disregarding assets will be increased from $50,000 to $60,000

–Schedule 1 requirement replaced with Schedules A, B, C (gain or loss greater than $10,000), D, E, F or H.

–If anyone in applicant’s household received certain means-tested federal benefits in the last two years, there will no longer be an income threshold

–The means-tested federal benefits include SSI, SNAP, TANF, WIC, Medicaid and Federal Housing Assistance (new)

–Free and Reduced Price School Lunch has been dropped from the list of means-tested federal benefits

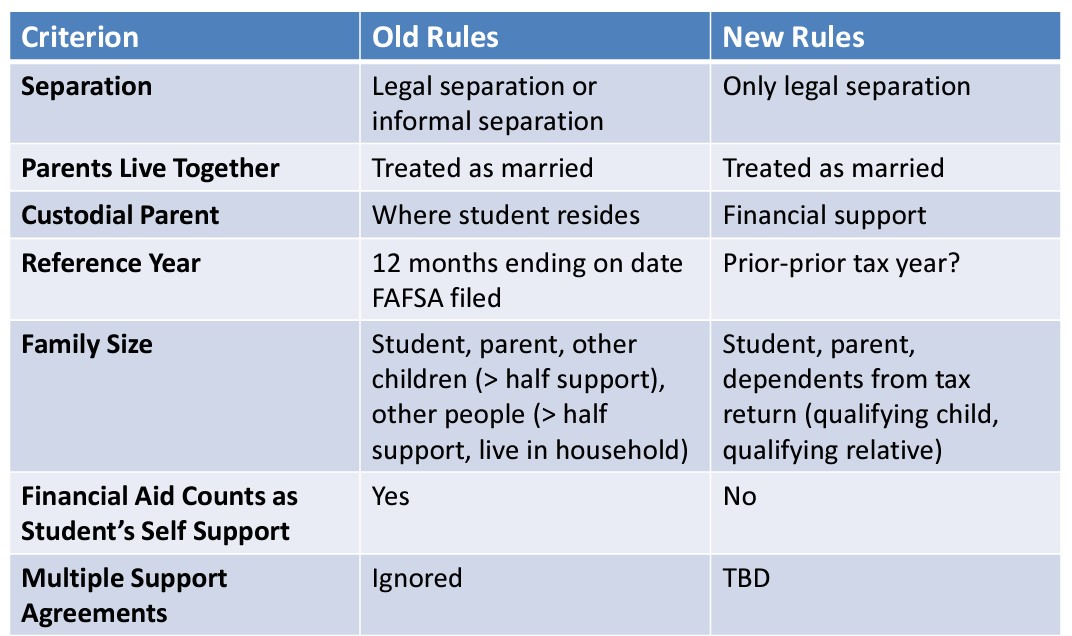

Which Parent Must Complete the FAFSA?

• When parents are divorced, separated or never married, and do not live together, only one parent must complete the FAFSA

–This will be the parent who provides more financial support to the student, no longer based on where the student lived the most

• If this parent has remarried as of the date the FAFSA is filed, the stepparent’s income, assets and dependents must be reported on the FAFSA

• Definition of family size has changed

–Student

–Student’s parents or student’s spouse (if any)

–Dependents from federal income tax returns in the prior-prior tax year

• Not yet specified

–Changes since the prior-prior year

–Multiple support agreements

Changes in Family Size

IRS Definition of Dependent

• Dependents include qualifying children and qualifying relatives

• Qualifying children

–Must live with the parent for more than half the year

–Must not provide more than half of their own financial support

–Financial aid no longer counts as part of the student’s selfsupport

–Must be under age 19 (24 if a full-time student)

–If the child is married, they must not file a joint return with their spouse

• Qualifying relative

–Dependents may include other people if they live with the parent and receive more than half their support from the parent

Custodial Parent vs. Family Size

• The custodial parent is the parent who must complete the FAFSA

• The new definition of custodial parent is not necessarily the same as the IRS definition of dependent, which is used in the determination of family size

• Which parent completes the FAFSA

–Currently based on where the student resides the most during the 12 months ending on the date the FAFSA is filed

–The new FAFSA will base it on whichever parent provided more financial support

• Family size

–The student is always counted in family size

–The new FAFSA requires the child to live with the parent for more than half the year and to not provide more than half of their own financial support, but does not require the parent to provide more than half of the child’s financial support